Heads up

To better understand whether you should perform a void or refund, see the support article What is the difference between void and refund.

How to

How do I void an invoice in the GT Backend?

Follow these steps

A void is the best option to take when you accidentally enter a sale twice or if a sale never took place. A void is a 1:1 copy of the original invoice with the same date, products, costs, and quantities in negative quantities.

To create a void, follow these steps.

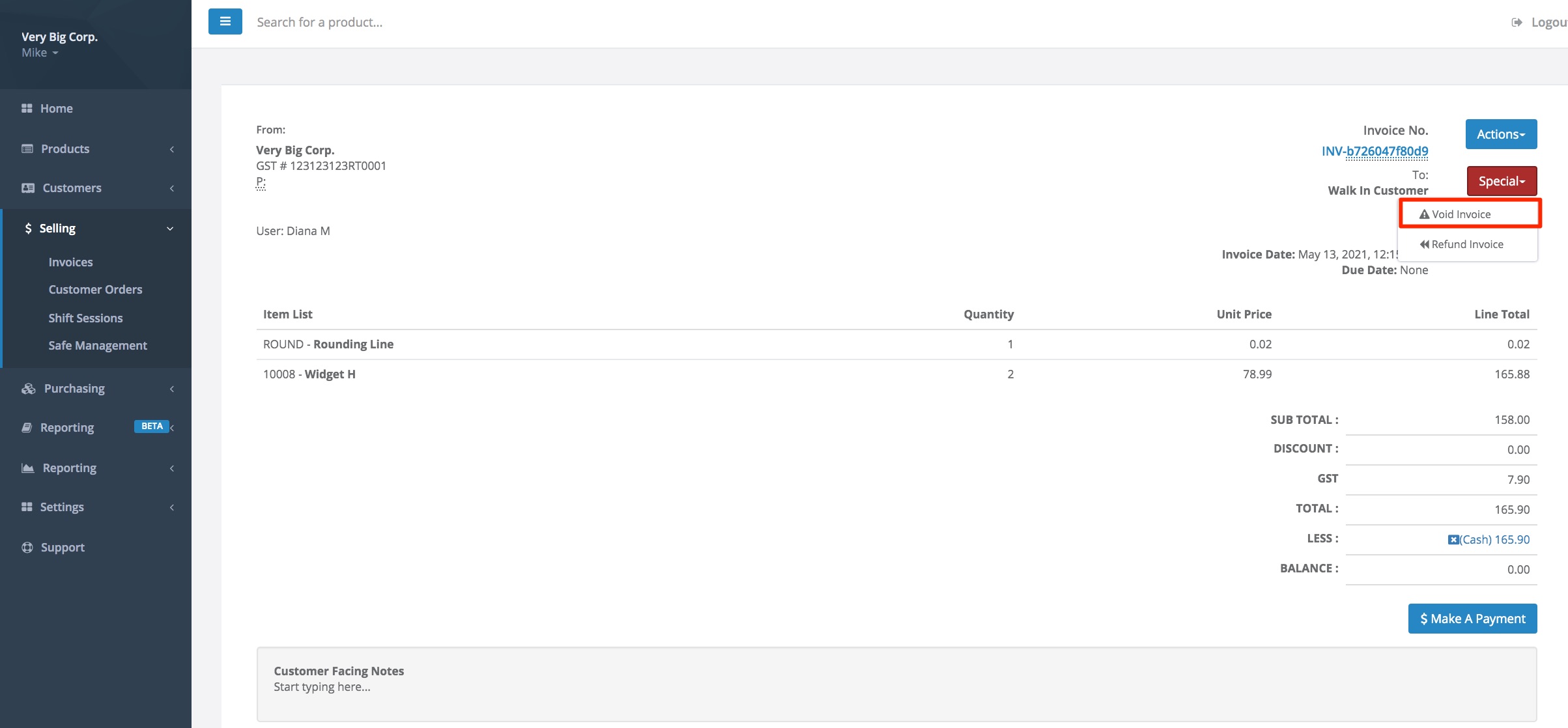

- Select Selling > Invoices.

- Locate the invoice.

- Select View or Edit.

- Select Special > Void Invoice.

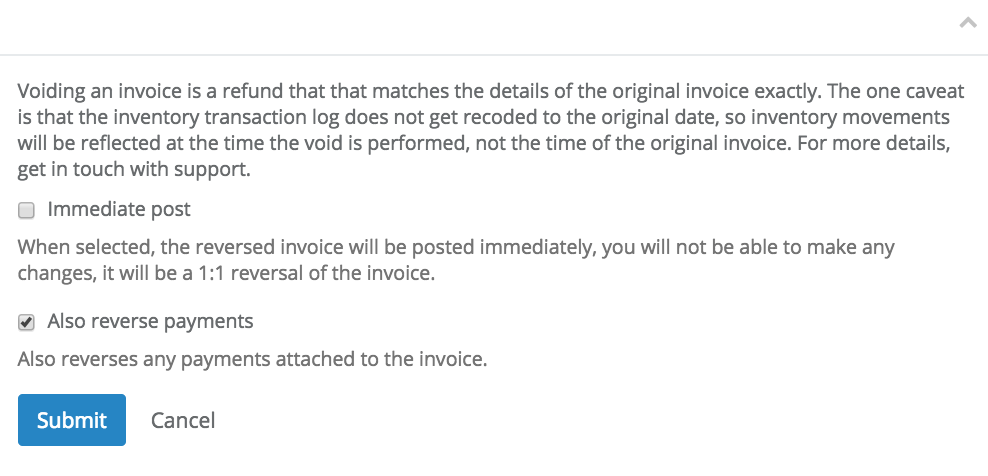

- If you need to make modifications to the voided invoice, uncheck Immediate Post so that you can modify the invoice before you save it. If you need to perform a void without making changes, leave Immediate Post checked to save it immediately. For more information, see information under the subheading, Changing a voided invoice before saving.

- If payment has not occurred, uncheck Also Reverse Payment. If the payment did happen and it needs to be refunded, check Also Reverse Payment. This option reverses the amount for recording purposes in the GT Backend only. It does not reverse the payment at your payment terminal. This should be done manually at your payment terminal.

- Select Submit.

Changing a voided invoice before saving

Sometimes, you may need to change a voided invoice before posting it. For example, suppose you accidentally sold two of a product, but only meant to sell one. In that case, you could void, uncheck Immediate Post, then edit the line item by changing the quantity from -2 to -1.

Comments

Please sign in to leave a comment.