How To

How do I enter a Coca-Cola supplier invoice?

Follow these steps

To enter a Coca-Cola invoice into GlobalTill, follow these steps.

Set up Coca-Cola as a supplier

To set up Coca-Cola as a supplier, follow these steps.

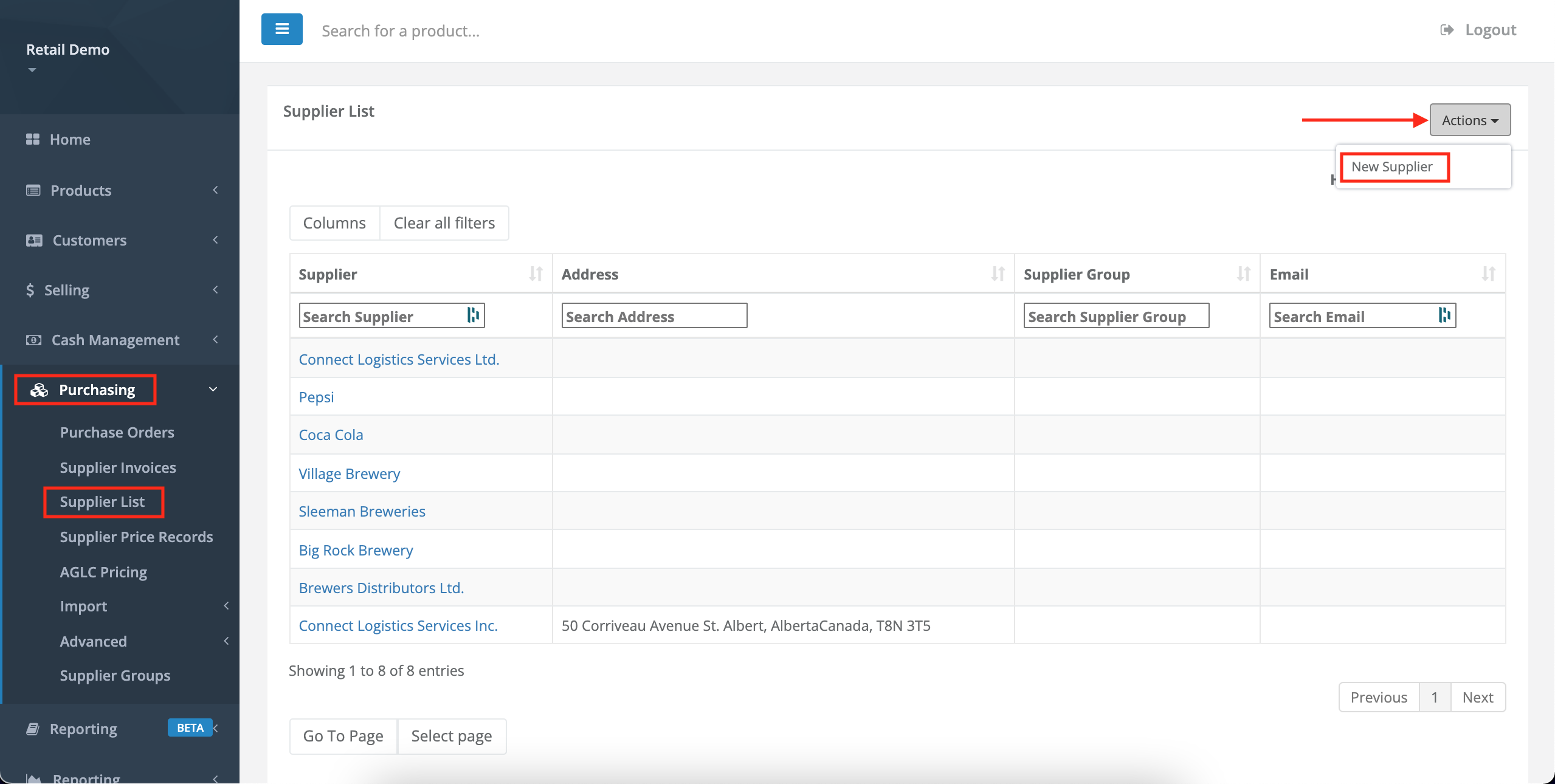

- Select Purchasing > Suppliers List.

- Select Actions > New Supplier.

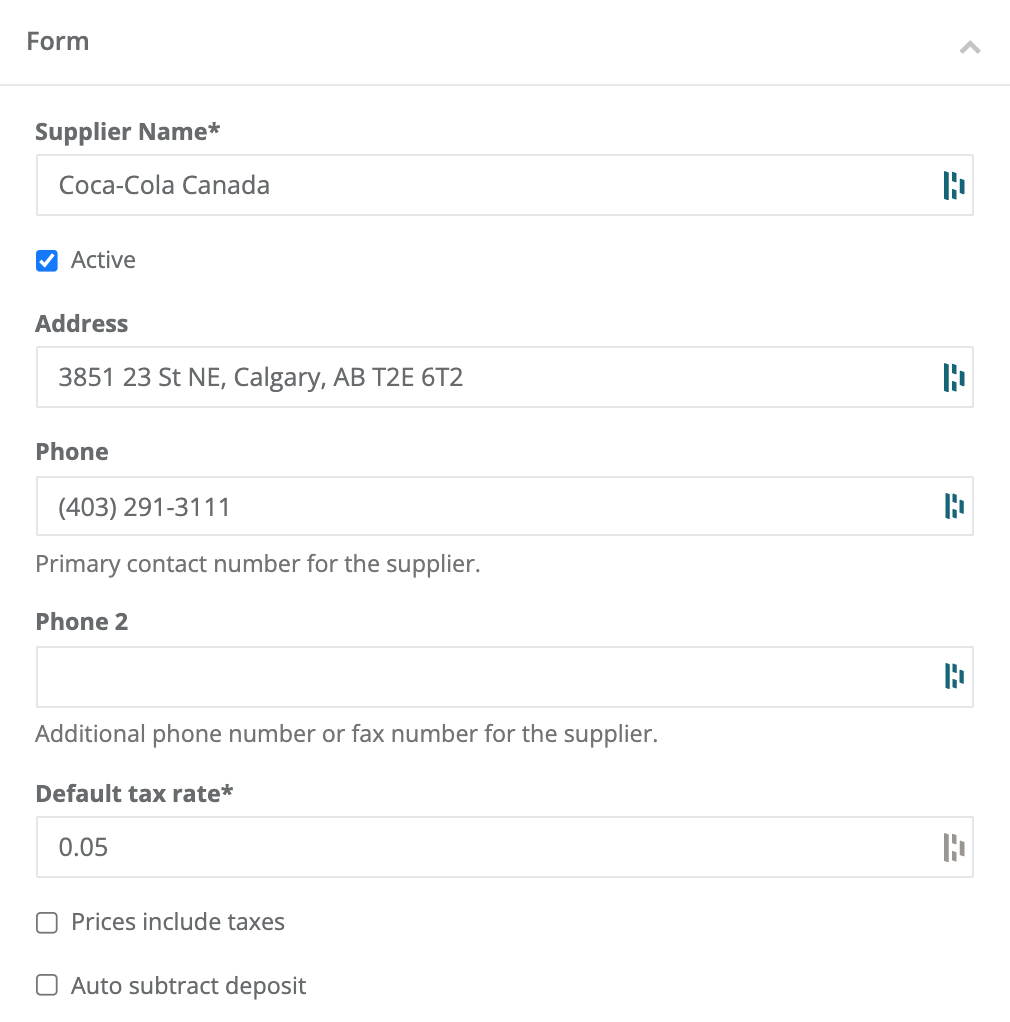

- Enter the Supplier Name as Coca-Cola Canada, and input the Default tax rate for your region.

- Ensure Prices includes taxes and Auto subtract deposit are both unchecked. Then select Submit.

Create the invoice

Once Coca-Cola is setup as a supplier, create and populate the invoice.

To create the invoice, follow these steps.

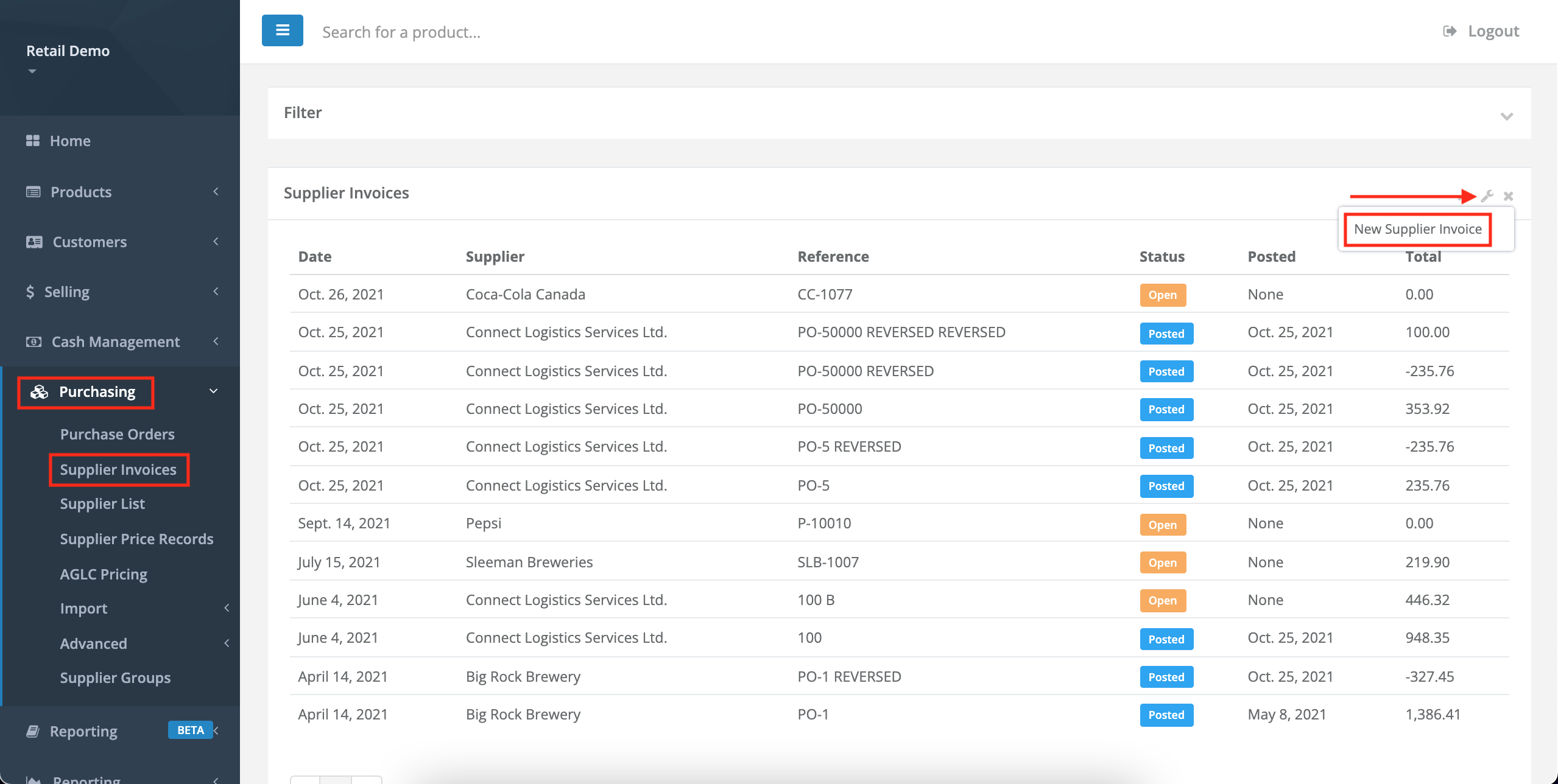

- Selecting Purchasing > Supplier Invoices.

- Select the Wrench icon > New Supplier Invoice.

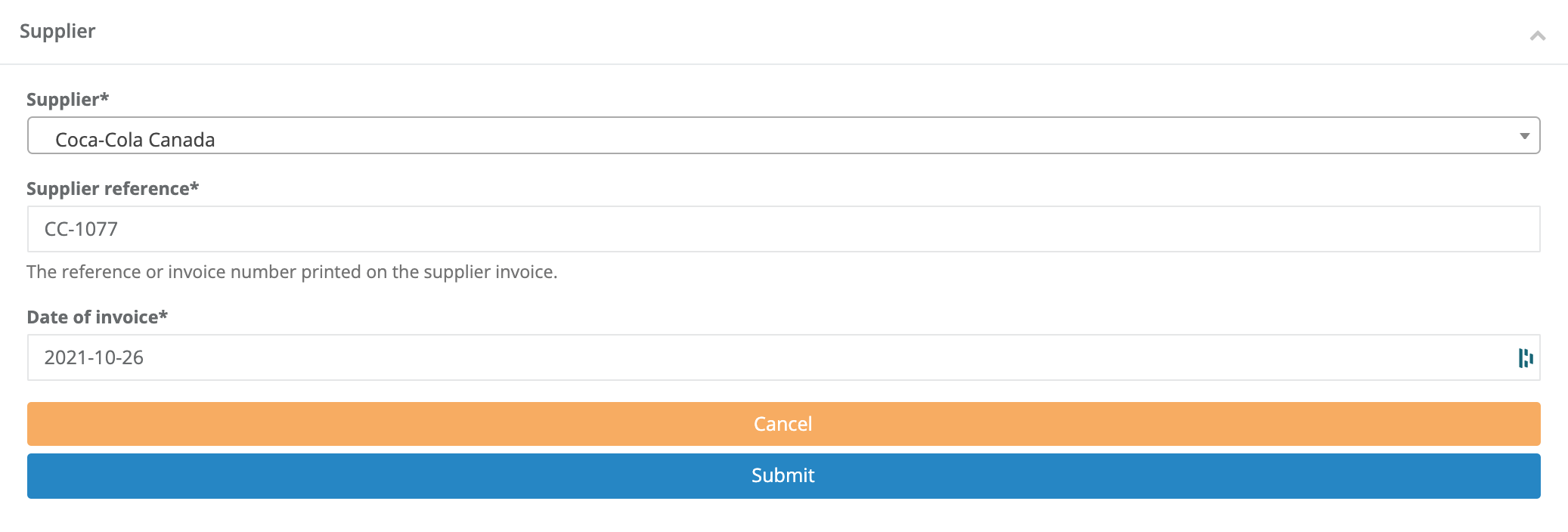

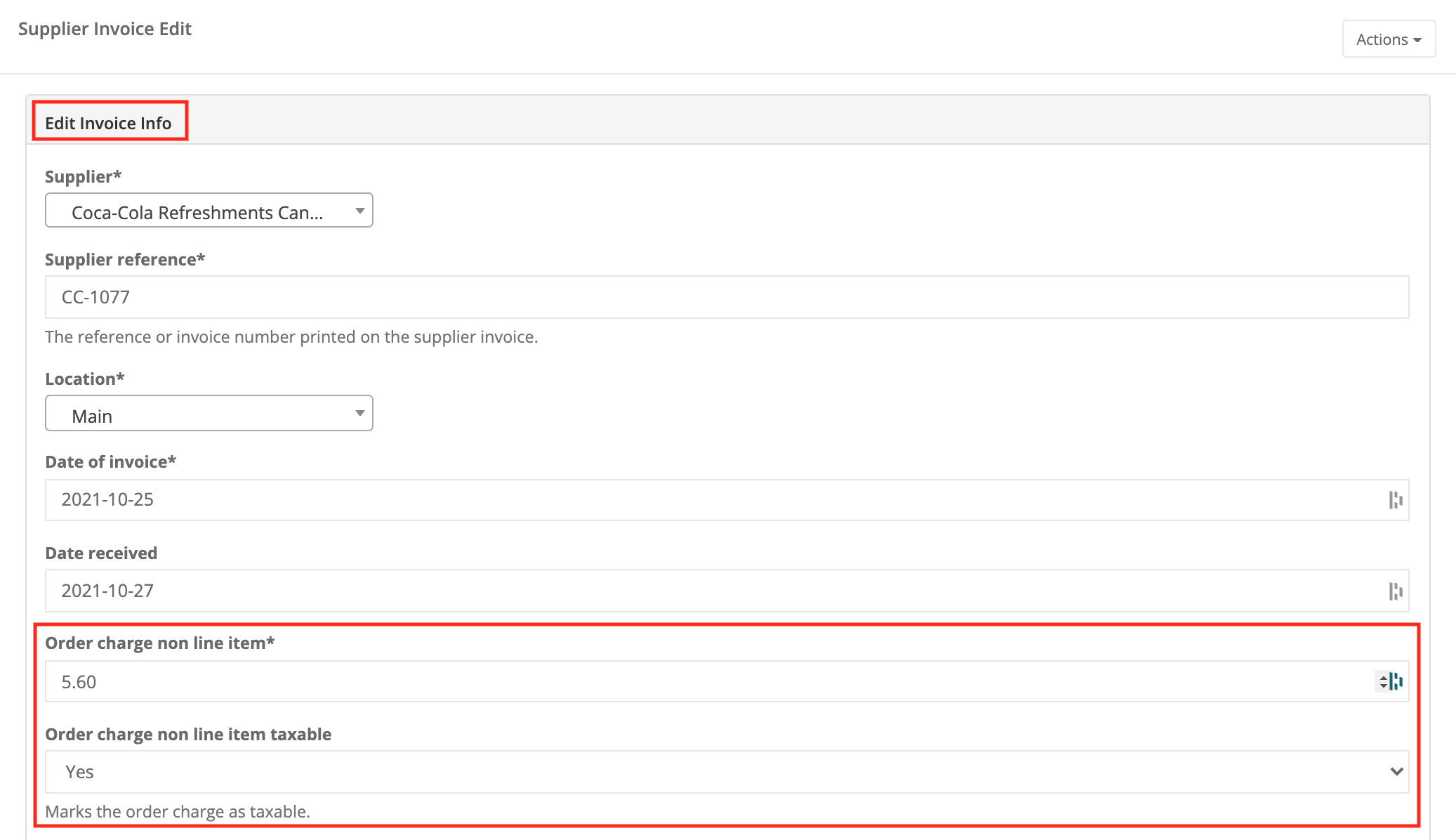

- Select Coca-Cola Canada as the supplier, enter the Date of invoice, enter the Supplier reference, then select Submit.

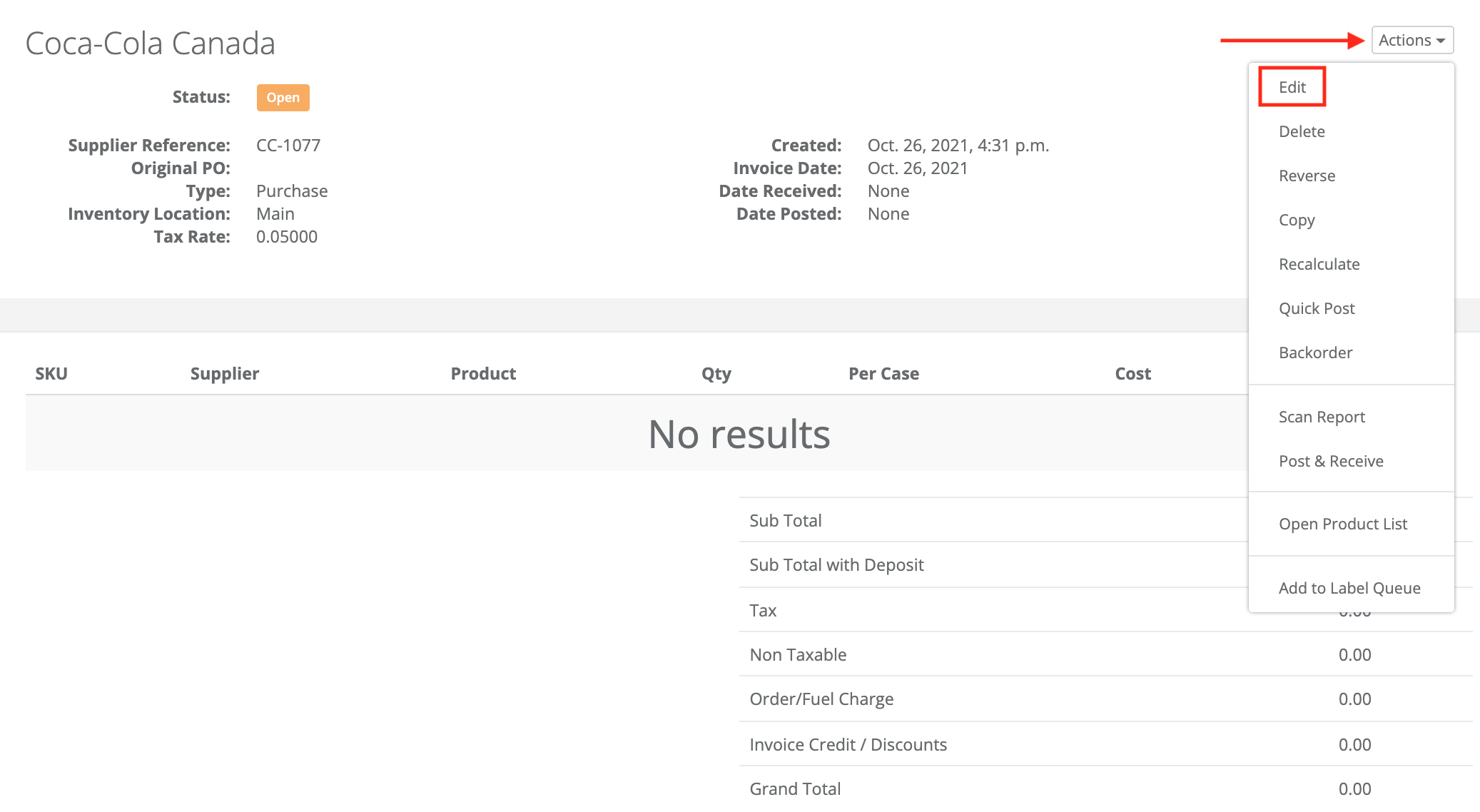

- From the blank invoice, select Actions > Edit.

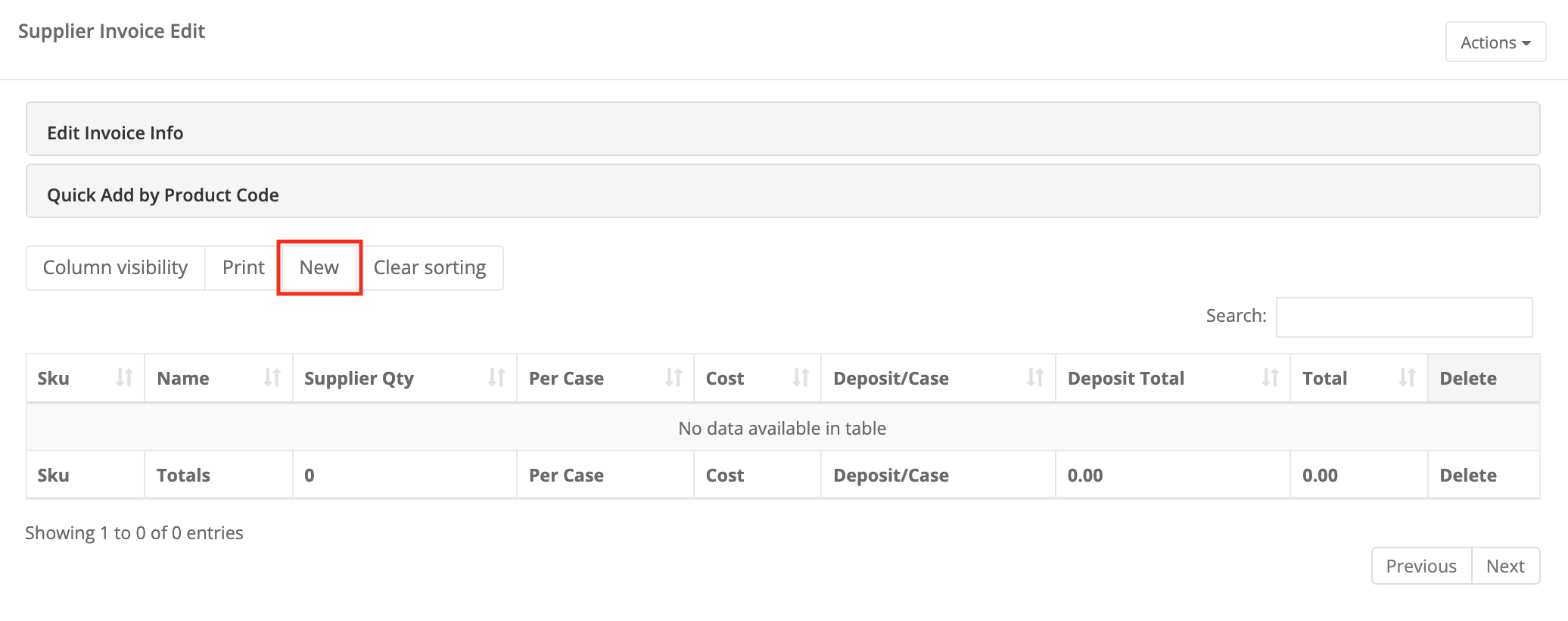

- Select New to add products.

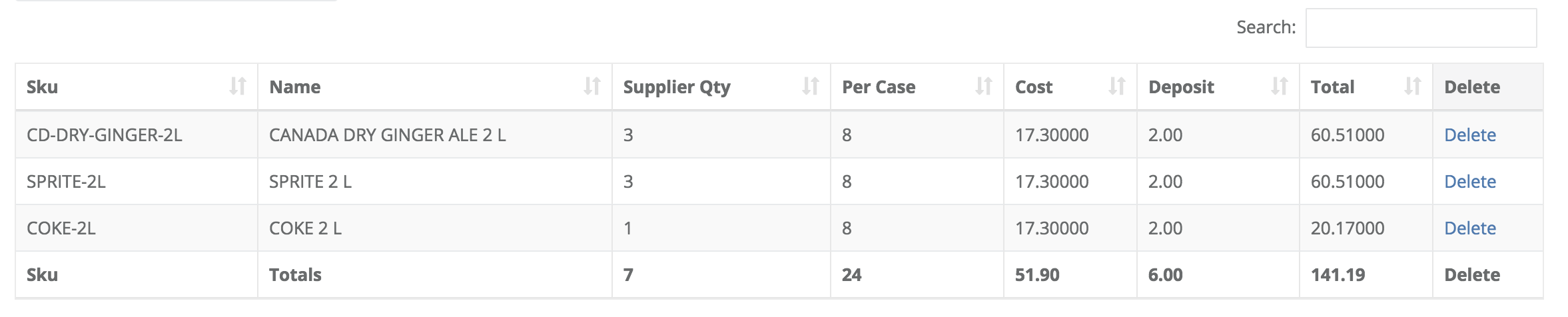

- In the Coca-Cola example below, enter the unit price as the cost into the GT Backend. Work from the email confirmation from Coca-Cola because their unit price includes GST, but does not include a deposit.

- In the GT Backend, the invoice is entered like this.

- Once your invoice is complete, post and receive the invoice as usual.

Frequently asked questions

- Why is the deposit $2.00?

For 2L bottles, GT follows the container deposit rule for Alberta, which is $0.25 on bottles larger than 1L. Eight bottles at $0.25 is $2.00 total. - How do I know the units per case?

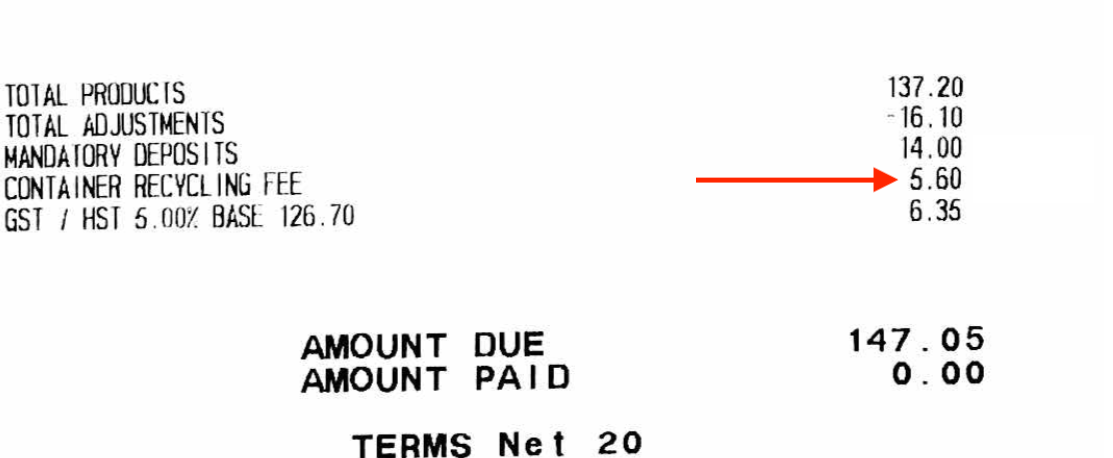

Some versions of the Coca-Cola invoices have the units per case in the product description, like 2x15x355 mL. However, not all versions do. When in doubt, consult with Coca-Cola directly. - The total of the GlobalTill invoice doesn't match my paper invoice. Why?

Coca-Cola has a non-line item fee called a container recycling fee. This is separate from government-mandated bottle deposits. You are not required to add this charge in GlobalTill, but you may if you want your order total to be closer to the balance.

Comments

Please sign in to leave a comment.